How Tariffs are Reshaping Auto Demand in Real-Time

The Market is Moving – and Fast

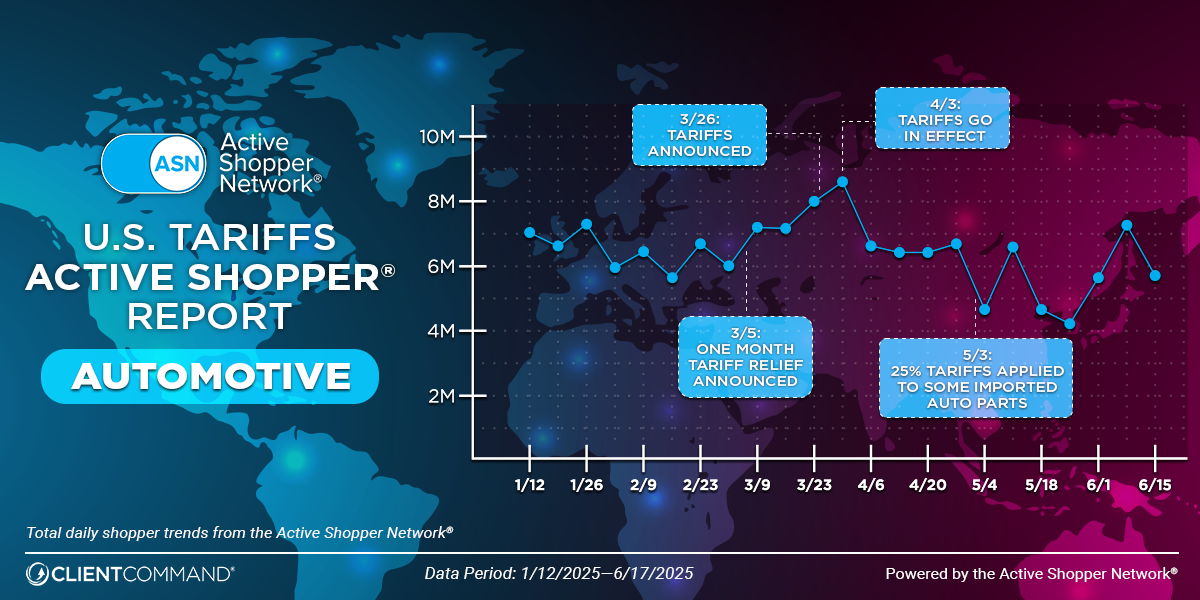

Over the past few months, the automotive market has become more volatile than at any point in recent memory. Pricing uncertainty, driven by evolving U.S. tariff policies and OEM cost responses, is directly influencing how, when, and why consumers shop for vehicles.

At Client Command®, we believe dealers need more than just a high-level view of these changes. They need clarity. That’s why our team has been releasing a weekly U.S. Tariffs Active Shopper® Report, powered by our Active Shopper Network® (ASN).

This report is designed to give dealers live insights into real-time consumer behavior, so they can act before the opportunity passes.

A Look Back at May: Volatility Takes Hold

In May, we witnessed just how sensitive the automotive market has become to tariff-related news. From May 15 to May 22, shopper activity surged briefly after a temporary tariff “relief” announcement, but that momentum quickly faded.

By May 23, activity dipped slightly below pre-announcement levels, reflecting broader consumer hesitation. Interest rate volatility, fluctuating inventory, and economic uncertainty all contributed to a modest but notable decline in both engagement and purchase intent.

By the end of the month (May 31 to June 6), the data showed a slow recovery, signaling that shoppers were beginning to adjust to the new normal. Still, the volatility revealed how fast buyer sentiment can swing, and why dealers can no longer afford to rely on static forecasts.

Shopper Demand is Pulsing, Not Slowing

One of the most striking trends we’ve seen is how quickly consumer activity is shifting.

In early June, shopper activity spiked across the U.S. automotive market. Just eight days later, it fell sharply.

This wasn’t a seasonal drop or a soft trend, it was a dramatic shift in buyer behavior in direct response to tariff policy changes and the pricing signals that followed. But just as quickly as demand dipped, it surged again. Aggressive OEM incentives began hitting the market, and consumers responded. Shoppers, concerned about future price increases, acted with urgency to take advantage of today’s deals.

That tells us something important: the market isn’t slowing down, it’s pulsing. Buyers are entering and exiting the market based on signals they receive from the economy, from OEMs, and from their own personal timelines. Static planning models can’t keep up. Real-time behavioral insight is now essential to navigating the landscape.

And this volatility isn’t isolated to week-over-week changes. When we step back and look at the monthly shopper data, the pattern becomes even more pronounced:

- January: 24,052,040

- February: 23,513,358

- March: 29,574,443

- April: 29,045,902

- May: 27,688,652

- June (so far): 20,371,004

The takeaway isn’t just that the numbers are moving, it’s that the people are, too. It’s not the same audience cycling through the funnel. Consumers are entering and exiting the market week to week, responding to external stimuli like pricing changes, incentive launches, and tariff announcements.

If you want to sell them a car, you have to reach them while they’re shopping. And that window is narrower than ever. The news cycle is influencing shopper behavior in real time, and if your marketing and sales strategy doesn’t reflect that, you’re missing the moment.

Traditional Planning Models are Falling Behind

Dealers are used to relying on historical trends to guide decision-making. But in this environment, history offers little guidance.

With tariffs, inventory pressure, and interest rates in flux, consumer behavior is being shaped in real-time. Sales and marketing strategies built around quarterly projections can’t respond quickly enough. By the time most teams notice a change, the market has already moved on.

That’s why real-time insight isn’t a luxury, it’s now a necessity.

Behavior is the New Intent Signal

What makes the Active Shopper Network® so powerful isn’t just its scale, it’s the immediacy and depth of the behavioral data it provides. ASN monitors online shopping behavior across 90% of connected devices in the U.S., allowing dealers to understand who is actively in market, what they’re shopping for, and how their behavior is evolving.

It also surfaces hidden opportunities.

For instance, many dealers don’t realize how often their own CRM leads, prior buyers, and service customers re-enter the market quietly. Without real-time insight, these customers slip away and convert elsewhere. But with the right signal, dealers can re-engage them early, before they defect.

OEM Incentives are Driving Urgency

Another clear pattern we’re seeing is how quickly shoppers respond to OEM pricing strategies. Over the past few weeks, as manufacturers introduced incentives to offset potential tariff-related price increases, we observed a near-immediate spike in activity.

Consumers are paying attention. They’re acting fast. And they’re highly sensitive to perceived timing advantages.

The takeaway? Dealers that adjust quickly will capture demand. Those that don’t will miss the moment entirely.

Dealers Need More Than Visibility, They Need Precision

This isn’t just about seeing the market shift. It’s about knowing how to respond – with the right message, to the right shopper, at the right time.

Whether it’s reworking media budgets, adjusting inventory plans, or identifying cross-shoppers early, the U.S. Tariffs Active Shopper® Report is built to support decision-making across the entire dealership.

Our goal isn’t to overwhelm dealers with more data, it’s to give them an edge. One that helps them not just weather change, but lead through it.

Stay Ahead of the Curve

We’ll continue releasing this report every week, tracking shopper trends and providing commentary on what the data means for your business. If you’d like to understand how this applies to your specific market, my team is ready to walk you through it.

Because while you can’t control the market, you can see it clearly. And that makes all the difference.

Schedule a demo today.

Give us 15 minutes of your time and we will show you how to engage with real shoppers as soon as they enter the market.

See firsthand:

-

How many people are actively shopping for a vehicle or looking to schedule service right now

-

How to reach them with highly efficient 1:1 marketing

-

How to drive more sales in less time with 27:1 ROI

Your Privacy Choices

Your Privacy Choices